The Rise of the Universal API

There’s been an explosion of startups in the API space in the last few years as more and more software companies have opened up their system for developers to build on top of their platforms. This wave of data interoperability across platforms has been accelerated by “Universal API” companies. The concept of a “Universal API” was born because each category of software now has several different players whether it's the CRM space with Hubspot, Salesforce, Zoho, Zendesk or the Commerce space with Shopify, WooCommerce, BigCommerce, Magento and more.

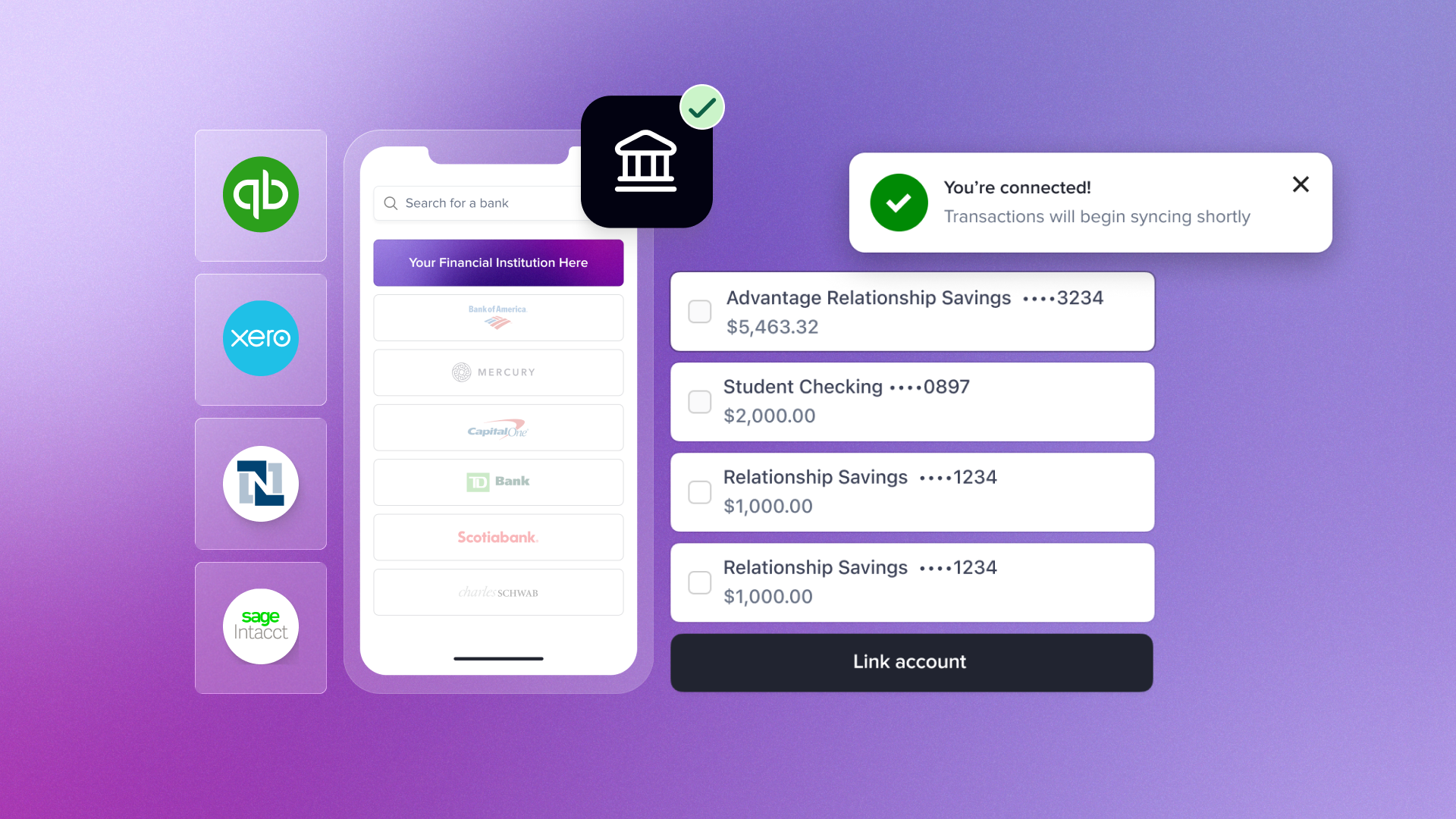

One of the early companies to pioneer the concept of a “Universal API” was Plaid that built a universal API for fintech companies to connect to banking systems. Companies like Venmo, Robinhood, Betterment, SoFi and more all rely on Plaid to power their connections to financial institutions. Since then we have seen an explosion of companies that have tackled building a “Universal API” for payroll, CRM, accounting systems, ecommerce, payments and more. Some of the notable companies in this category include Pinwheel, Teller, Atomic, Argyle and more.

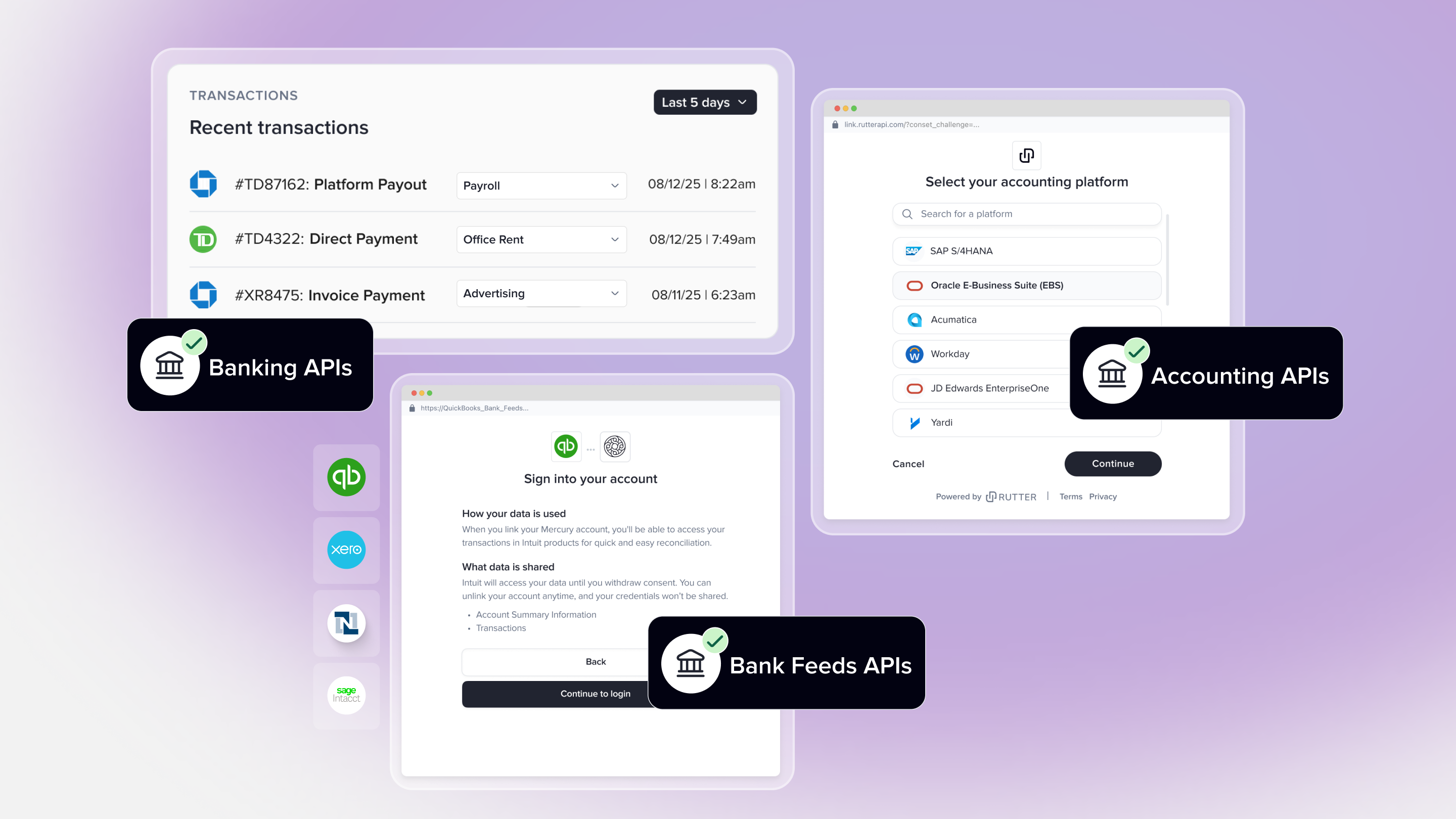

In this post, we dig into why engineering and product teams turn to Universal API companies, how Rutter is building the Universal API for Commerce, and what that means. In a previous post, we also outlined some of the top fintech use cases that Rutter powers using our set of Commerce APIs and our recently launched Accounting APIs as well.

Universal APIs allow developers to move faster

Engineering and product teams turn to Universal API companies to help them with a few key things:

- Accelerating Their Product Roadmap - Often companies will start with integrating with the major platforms before being able to move into the longer tail of platforms. With Universal APIs, companies are able to speed up their development process and integrate with several platforms from the get go. This also frees up time for the product team to go back to focusing on their core product and tackle other features on their roadmap instead of having to build integrations across several quarters.

- Increasing Go-to-Market Coverage - GTM teams love Universal APIs since it allows them to serve more types of customers across the various platforms. For example, with Rutter, fintech companies can serve customers from platforms like Shopify, WooCommerce, BigCommerce, Quickbooks, Xero and more from Day 1.

- Saving Engineering Resources & Reducing Maintenance Costs - We’ve heard from companies that we work with at Rutter that each integration takes them several weeks and 2-3 engineers just to build. Add in the additional maintenance costs and every engineering team is eager to find a better solution to building and maintaining these integrations. Universal APIs are able to save engineering teams hundreds of hours a year while freeing them up from the burden of having to maintain and update these integrations as well.

- Tapping Into Industry & Integration Expertise - The integrations problem is a hairy problem that no engineer likes dealing with because of the nuances and complexity behind every platform whether it’s the structure of the APIs to the lack of documentation to the rate limits to dealing with the authentication flow of each platform, teams choose to use Universal APIs because the companies building them have spent thousands of hours focused on solving the integration problem, developing best practices around the various platforms for that industry and finding all the gotcha’s and limitations of every platform.

All of this combined allows companies to move faster, build new products, serve more customers and save on costs. We wrote a more in-depth post as well on why teams choose to buy vs build.

The Universal API for Commerce

At Rutter, we’ve built the Universal API for Commerce which allows any developer to connect to any ecommerce platform, marketplace, accounting system or payment processor in record speed. What types of data are developers able to pull from a Universal Commerce API?

- Ecommerce Data - Rutter’s Universal Ecommerce API allows companies to pull data from any business operating on an ecommerce storefront platform like Shopify, WooCommerce, Magento or an ecommerce marketplace like Amazon, Walmart, Target and more. Endpoints include sales, orders, customers, inventory data and more.

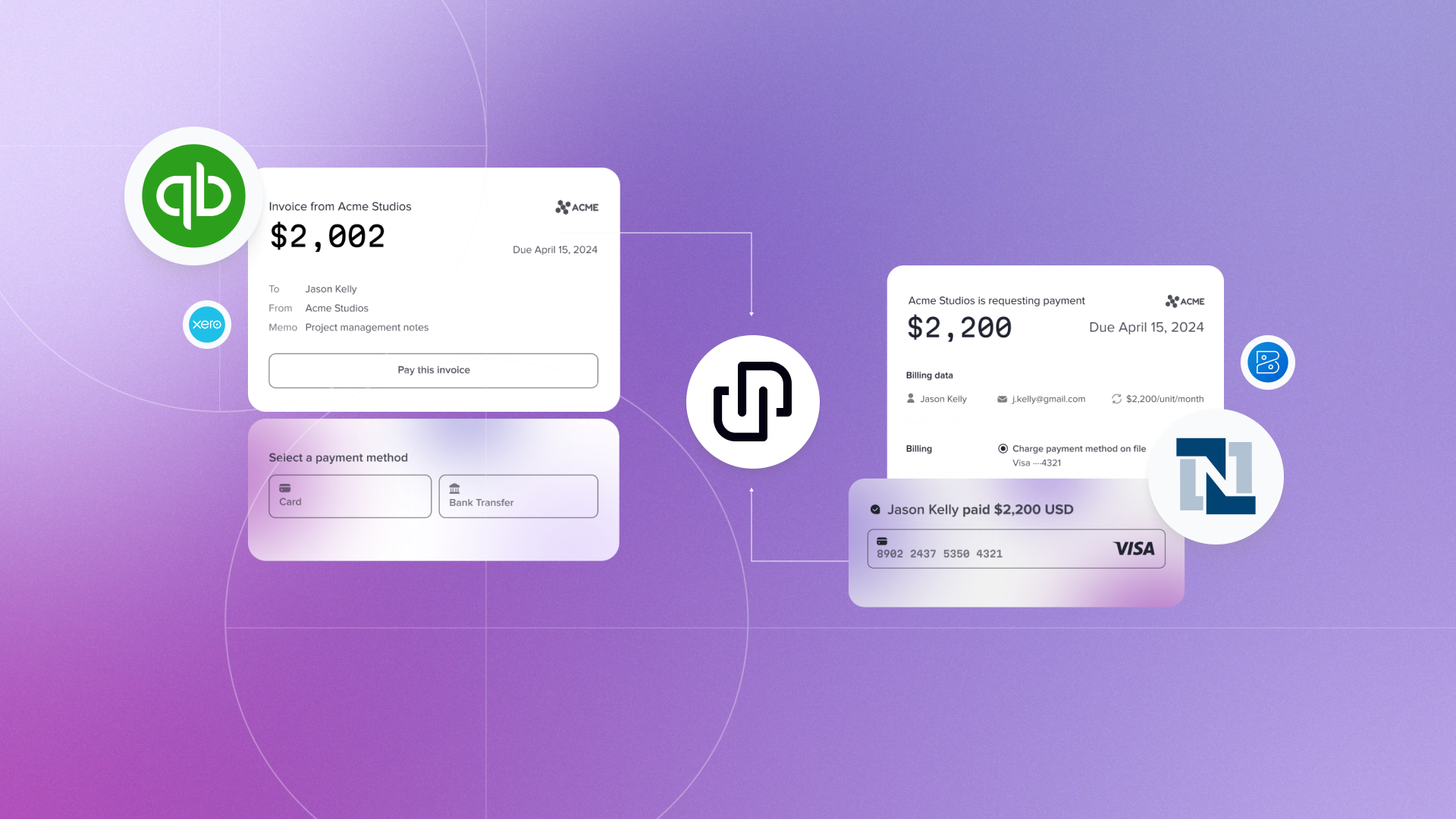

- Accounting Data - Rutter’s Universal Accounting API allows companies to pull data from any business using an accounting platform like Quickbooks, Xero, Netsuite, Sage and more. Endpoints include income statements, balance sheet, invoices and more.

- Payment Processor Data - Rutter’s Universal Payment Processor API allows companies to pull data from any business using payment processors like Stripe, Paypal, Adyen, Braintree and more. Endpoints include transactions, amount, payouts, balances and more.

Today, Rutter works with several of the top fintech lending startups, credit card companies, business banks and any other company that needs to read and write data from commerce platforms. Companies like Ramp use Rutter to build integrations to platforms like Shopify, Amazon, WooCommerce, Etsy and more. These integrations allow Ramp to offer better limits for the corporate cards they offer businesses and merchants by taking in additional data points around sales, orders, transactions, inventory and more via Rutter’s Universal Commerce API.

These companies choose to work with Rutter in order to increase speed to market, save on engineering resources and maintenance costs and be able to focus on their core product. Rutter provides a universal schema and authentication flow across 25+ different commerce platforms while also optimizing the historical data fetch and rate limits associated with each one.

The ability to easily integrate with all these commerce platforms from Day 1 allows fintechs to move faster and start accessing data of SMBs and merchants for the financial products they're building. At Rutter, we're excited to be building the future of commerce data and helping companies build new fintech and commerce experiences.